The future of sustainability is intrinsically linked to the positive correlation between sustainability and organisational efficiency. Organisations that embed sustainability into their values and core processes are more likely to achieve long-term success, as they are geared to create products and services while optimising resources.

The world has seen a paradigm shift to sustainability. Who you are and where you fit into this loop will vary. Countries and corporations will change focus between energy efficiency, net zero, value chain, circular economy, social factors, and so on. But unless you are the US President, you will have to take off your blinkers and change with the times.

Sustainability needs to be brought into the mainstream, rather than categorising sustainability initiatives as regulatory, charity or public relations initiatives. The future of sustainability will evolve as the distinction between between sustainability initiatives and any other investments disappears – whether the investment is for people or process, upgrade or expansion, production or service, et cetera.

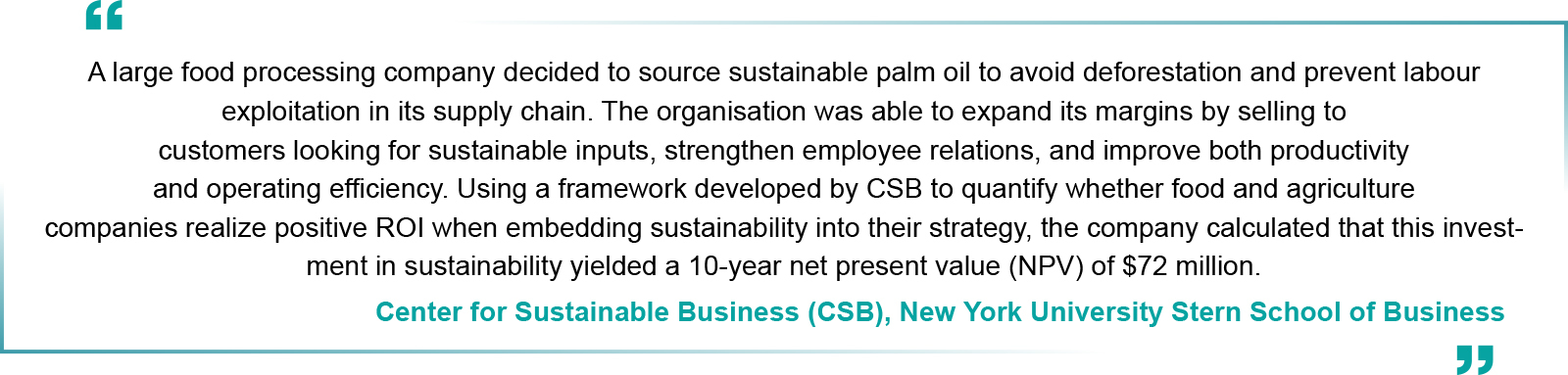

For a sustainable future, the ROI (Return on Investment) on all investments should pass the Triple Bottom Line test of social, environmental, and financial performance. This will encourage all departments, competing for the same pool of resources, to view their business strategy through a sustainability lens. An initiative in one department can yield benefits in another function, and identifying, quantifying and communicating these benefits, creates a unified team.

The complexity of the Triple Bottom Line approach lies in the multidimensional nature of sustainability, and the challenge to recognise, and monetise, the value of indirect and intangible factors.

Measuring Sustainability ROI might seem like a daunting task. But keep in mind that a well rounded, if not 100% perfect, Triple Bottom Line calculation is a much better comparative measure than a purely financial ROI.

To get started with measuring Sustainability ROI:

Taking a wholistic view also reveals the risks that could result from a particular investment strategy. Thus strategy can be tweaked, or risk mitigation measures put in place, to prevent or minimise any fallout.

To help identify intangible benefits, start with key performance indicators (KPIs) aligned to your company’s sustainability goals, and list indicators that could be affected by the proposed initiative. Thereafter, measure the anticipated impact on each indicator, and quantify the intangible benefits. These free tools and resources from NYU Stern Centre for Sustainable Business can help you identify indicators and quantify the intangible benefits in a methodical, pre-tested manner.

Talent Attraction, Productivity,

and Retention

Employee Wellbeing

Monetization Tool

Commodity Supply

Chains

Global companies, including Unilever, Ikea, Walmart and others, have experimented and found that Sustainability Pays.

CSB research reveals that companies undervalue the benefits of sustainability strategies, as they don’t have, or don’t measure, the right data. Scientifically measuring, and effectively communicating, the full value of investments showcases the payback of sustainability, and helps garner internal and external stakeholder support.

Each month GovEVA’s ESG in Practice features a different topic, relevant to industry in their ESG journey.

VOTE HERE for what YOU want to read about.

5 Million+ Customer Transactions Each Month

AI-Powered ESG Management

and Reporting, Enabled by Domain Experts

GovEVA is a leading cutting-edge digital ESG SaaS platform. Our vision is to empower large enterprises to digitize and streamline their sustainability journey, ensuring they meet their ESG goals efficiently and effectively.

A1, 8th Floor, Chander Mukhi Building,

Ramnath Goenka Marg, Nariman Point,

Mumbai – 400021, Maharashtra, India.

+91 98202 22089

Info@goveva.com

Copyright @2024 GovEVA. All rights reserved. ![]()

![]()